Actualizado el 03/02/2026

Mobile paymentsEscrito por Redacción TNI el 13/03/2018 a las 20:52:021711

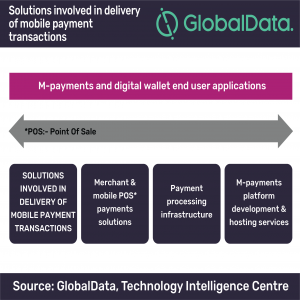

The m-payment (mobile payment) ecosystem has been transforming globally into a dynamic value chain comprising numerous participants from the financial, Internet and retails sectors. These players interact to make m-payment transactions possible through a multitude of solutions, according to GlobalData, a leading data and analytics company.

Furthermore, a wide variety of players are active in the commercialization of m-payments, resulting in a highly fragmented and competitive environment. These include mobile operators, banks, governments, smartphone operating system players, fintech companies, card networks and merchants offering m-payment services and mobile wallets. Each of the players striving to own a piece of the market.

Joel Cooper, Global Telecom Director at GlobalData, comments: “The Middle East, specifically, is witnessing a burgeoning m-payments market with a number of players offering a multitude of m-payment services.

“In Kuwait, for instance, One Pay and Quickpay enable customers to pay for their bills (including rent, pay-TV subscriptions, school fees and international payments) from a dedicated mobile app. Furthermore, the National Bank of Kuwait made its contactless payment service NBK Tap & Pay available this year on customers’ wristbands. Moreover, Kuwait Finance House launched its KFH Wallet in 2017 enabling users to perform mobile payments at merchants’ NFC (Near-Field Communication) POS terminals in the country.”

The UAE is another country that has seen a boom in the number of available m-payment services. Mobile operator Etisalat, for instance, launched its mobile wallet, Etisalat Wallet, in 2016. Emirates NBD bank released in 2016, NBD Pay, a contactless payment service enabling purchases at NFC-compatible POS terminals. Samsung Pay and Apple Pay arrived to the UAE in 2017. In addition, a consortium of 16 banks in the UAE is working on launching the Emirates Digital Wallet (EDW), offering a multitude of m-payment services such as m-POS payments and m-P2P bank payments. |